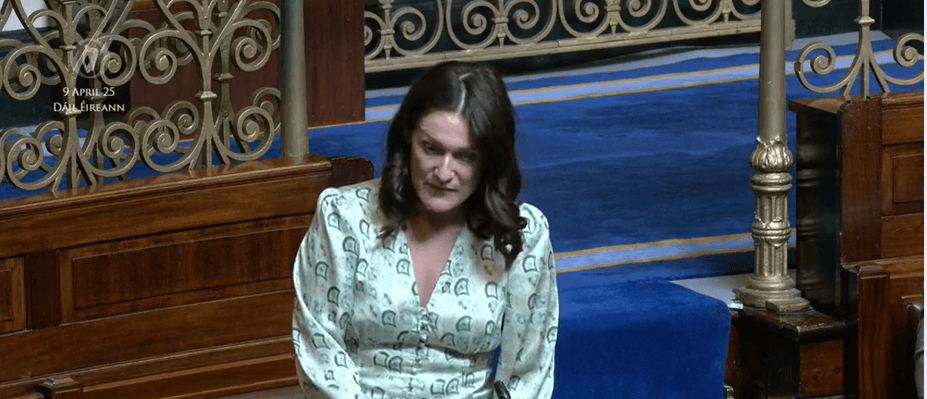

Local Fianna Fáil Senator Erin McGreehan has said Budget 2025 will deliver targeted supports to people, families and businesses to alleviate pressures caused by the increased cost of living.

Senator McGreehan said, “In Budget 2025 we are implementing measures to protect the most vulnerable in society, give families and households a break, safeguard the economy and prepare for the future.

“We want to cushion people, families, pensioners and businesses from the impact of inflation over recent years. That is why we are giving every household €250 in energy credits this Winter.

“Fianna Fáil in Government has championed increases to the State pension and prioritised the well-being of older people and the most vulnerable. Budget 2025 sees a €12 rise in all weekly social protection payments and lowers the eligibility age for the Fuel Allowance from 70 to 66.”

Senator McGreehan said Budget 2025 marks the most any Government has ever spent on housing. She said: “This budget sees the most any Government has ever invested in housing. Over 115,000 new homes have been completed since we entered government in 2020. We are guaranteeing the Help-to-Buy scheme will be in place to the end of the decade and for renters we are increasing the renters tax credit for both this year and next to €1,000 per renter to help them with the cost of rent.”

She said Budget 2025 builds on Fianna Fail’s reform of the healthcare and education sectors, while providing supports to low- and middle-income workers and SMEs. She said: “In healthcare we are focused on affordability and universal access based on need, not ability to pay. We are increasing investment in mental health services and addressing overcrowding and waiting lists by expanding surgical hubs, fully funding the National Cancer Strategy, and rolling out free HRT for women.

“As a party, we believe in the power of education, and we believe in making education truly accessible for all. In Budget 2025 we have fully expanded the free schoolbooks scheme to cover all children in primary and secondary school, easing the financial burden on families, and we have increased investment in infrastructure, staffing, and special needs education including an additional 1,600 SNAs and 750 Special Education teachers.

“Budget 2025 prioritises those who need it most, offering significant income tax relief to help address ongoing cost-of-living pressures. Under Fianna Fáil, the average worker will be approximately €1,000 better off, thanks to a combination of income tax cuts and targeted cost-of-living supports.

“We have provided unprecedented supports to SMEs across the country which are the backbone of our economy, providing jobs and supporting local communities. Budget 2025 measures will provide direct cost-of-doing-business support grants of up to €4,000, reduce complexity, boost Ireland’s attractiveness as a place to do business, support innovation and provide (delete for) a range of new and enhanced tax relief schemes and incentives.”

Senator McGreehan concluded: “Fianna Fail’s Budget prioritises helping people, families and businesses with the increased cost of living, and increasing investment in housing, water, energy and key infrastructural projects will protect Ireland’s progress and secure our future.”

Some of the key measures in Budget 2025 include:

- A €12 increase in the state pension.

- Over-70s are to benefit from a new “bring a friend” expansion of the free travel scheme.

- The point at which people pay the higher rate of tax of 40% will increase from €42,000 to €44,000.

- The personal, employee PAYE and earned income tax credits will go up by €125.

- The 4% rate of Universal Social Charge is reduced from 4% to 3% on incomes €25,000 to €70,000.

- Parents of newborns will receive a one-off payment of €420.

- €15 weekly increase in maternity, paternity and parents’ benefit.

- Free IVF scheme will be expanded.

- Two double payments of Child Benefit in November and December.

- A double payment of all welfare rates in October and December.

- A €400 lump sum for those in receipt of the working family payment.

- Weekly social welfare payments such as the state pension, Carer’s Allowance. disability payments and Jobseeker’s Allowance will rise by €12.

- Students will get €1,000 off their college fees and postgraduate students will see their fee contribution grant increase from €4,000 to €5,000.

- Free hormone replacement therapy (HRT) for women.

- Renters tax credit will increase to €1,000.

- Expansion of free schoolbooks to all second level students.

For further information reach out to Erin McGreehan.

-ENDS-